Maximizing Healthcare Insurance Coverage With Medicare Benefit Insurance

As the landscape of healthcare continues to progress, individuals looking for detailed protection commonly transform to Medicare Benefit insurance policy for a much more inclusive strategy to their medical needs. The appeal of Medicare Advantage hinges on its potential to supply a wider range of solutions beyond what standard Medicare strategies supply. By checking out the benefits of this option, understanding enrollment procedures, and revealing cost-saving methods, individuals can unlock a globe of medical care opportunities that deal with their distinct needs. What precisely does optimizing health care coverage with Medicare Benefit require? Let's explore the intricacies of this insurance policy choice to discover how it can be maximized for your health care journey.

Benefits of Medicare Benefit

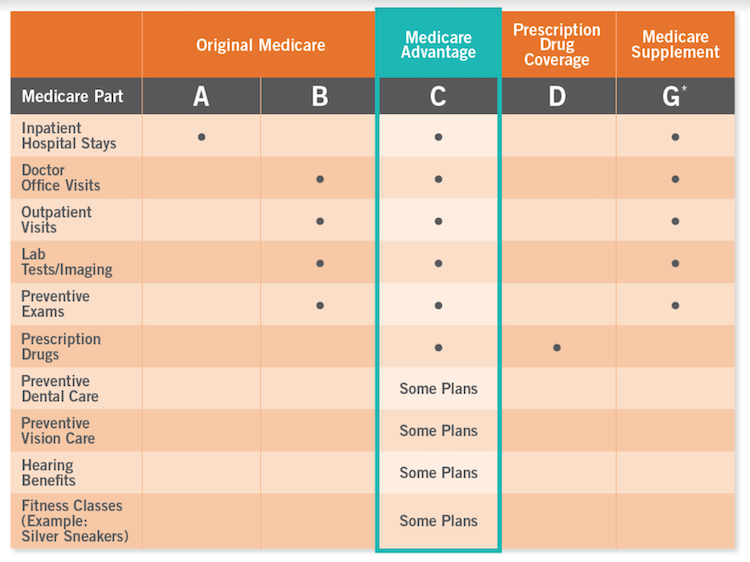

Medicare Benefit intends, also understood as Medicare Component C, provide a number of advantages that establish them apart from typical Medicare strategies. One crucial benefit is that Medicare Advantage prepares commonly consist of additional protection not provided by initial Medicare, such as vision, dental, hearing, and prescription medication protection.

Additionally, Medicare Advantage prepares usually have out-of-pocket maximums, which limit the quantity of cash a beneficiary has to invest in protected solutions in a given year. This financial protection can give satisfaction and assistance individuals budget for medical care expenses a lot more efficiently (Medicare advantage plans near me). Additionally, many Medicare Benefit prepares offer health programs and various other precautionary services that can aid recipients stay healthy and manage chronic problems

Registration and Eligibility Criteria

Medicare Advantage plans have particular enrollment requirements and eligibility standards that people must meet to enroll in these comprehensive health care insurance coverage alternatives. To be eligible for Medicare Advantage, people have to be enlisted in Medicare Component A and Part B, additionally referred to as Initial Medicare. In addition, most Medicare Benefit prepares require applicants to live within the plan's service area and not have end-stage renal illness (ESRD) at the time of registration, though there are some exemptions for people already enrolled in an Unique Requirements Plan (SNP) customized for ESRD individuals.

Cost-saving Opportunities

After guaranteeing qualification and enrolling in a Medicare Advantage strategy, individuals can check out numerous try this site cost-saving opportunities to optimize their medical care protection. One considerable way to save prices with Medicare Advantage is through the strategy's out-of-pocket optimum limit. When this restriction is reached, the plan normally covers all additional approved clinical expenditures for the rest of the year, offering economic alleviation to the beneficiary.

One more cost-saving possibility is to utilize in-network health care service providers. Medicare Benefit plans typically bargain affordable rates with particular physicians, health centers, and pharmacies. By staying within the plan's network, individuals can benefit from these lower prices, inevitably lowering their out-of-pocket expenditures.

Furthermore, some Medicare Advantage plans offer additional benefits such as vision, dental, hearing, and wellness programs, which can assist individuals conserve cash on solutions that Original Medicare does not cover. Making the most of these added benefits can lead to significant price financial savings over time.

Extra Coverage Options

Exploring auxiliary healthcare advantages past the standard insurance wikipedia reference coverage supplied by Medicare Benefit plans can enhance overall health and health end results for recipients. These extra coverage options frequently include solutions such as oral, vision, hearing, and prescription medication protection, which are not generally covered by Original Medicare. By availing these extra advantages, Medicare Advantage recipients can attend to a broader series of healthcare demands, causing improved lifestyle and browse around these guys far better health and wellness management.

Dental insurance coverage under Medicare Benefit strategies can include regular exams, cleanings, and even significant dental treatments like root canals or dentures. Vision advantages may cover eye exams, glasses, or call lenses, while hearing coverage can assist with listening devices and relevant services. Prescription medicine protection, also referred to as Medicare Part D, is critical for handling drug expenses.

In Addition, some Medicare Advantage intends offer added perks such as health club memberships, telehealth solutions, transportation help, and over-the-counter allocations. These additional advantages contribute to an extra extensive medical care method, advertising preventive care and prompt treatments to support recipients' health and wellness.

Tips for Maximizing Your Strategy

Exactly how can beneficiaries make one of the most out of their Medicare Advantage strategy insurance coverage while making best use of medical care benefits? Below are some crucial suggestions to help you maximize your plan:

Understand Your Insurance Coverage: Put in the time to evaluate your strategy's advantages, including what is covered, any constraints or restrictions, and any out-of-pocket costs you might incur. Knowing your insurance coverage can aid you make notified health care decisions.

Benefit From Preventive Providers: Several Medicare Advantage plans deal insurance coverage for preventive solutions like testings, vaccinations, and wellness programs at no additional expense - Medicare advantage plans near me. By keeping up to date on preventive care, you can assist preserve your health and wellness and potentially avoid more severe health problems

Evaluation Your Drugs: Make certain your prescription medicines are covered by your plan and check out possibilities to save money on costs, such as mail-order drug stores or generic options.

Verdict

In verdict, Medicare Benefit insurance offers countless advantages, cost-saving possibilities, and additional insurance coverage choices for eligible individuals. Medicare advantage plans near me. By optimizing your strategy and capitalizing on these advantages, you can ensure thorough healthcare coverage. It is very important to carefully assess enrollment and eligibility standards to make the many of your strategy. With the appropriate approach, you can maximize your healthcare insurance coverage and gain access to the care you need.